- Ad Hoc Dates For Net Worth Report In Quicken For Mac

- Ad Hoc Dates For Net Worth Report In Quicken For Mac

Around 2001, I was part of a rather ad hoc/informal effort to support OpenAFS in MacOS. I describe it that way because ultimately my skills were ill-suited for the role I was asked to perform - you could say I was simply the wrong person in the right place. Quicken has been around for some time and used to be one of the main money related management application worth utilizing. With the ascent of such a large number of fintechs offering extraordinary Quicken alternatives, Quicken is never again ruler of the slope.

. Top Reviews. Guides. Close. Best. Top Reviews.

Guides. Close. Best Solutions. Top Reviews.

Guides. Close. Life. Auto. Health.

Other. Close. Close. Updates. Reviews.

Guide. Close. Wealth Management. Debt Reduction.

Retirement. Close. Quicken has helped millions of people budget and manage their money. But is it right for you? Find out in our detailed Quicken review.

We’ve always been fans of Quicken here at Consumerism Commentary, and we’ve got a lot of reviews floating around to prove it. But you don’t really need reviews of Quicken from five years ago. You just need to know what to expect from the latest version: Quicken 2017.

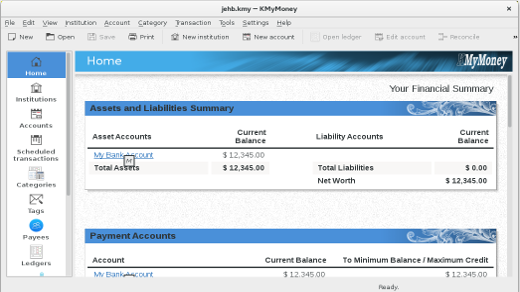

Here, we’ll give you the highlights, and we’ll also talk you through the basics of using this interface. The Highlights Quicken still provides everything you’ve come to expect, including the ability to track all of your money in one place.

If you’re big on, it’ll help you do that. It tracks both assets and debts, and it will also track investments. (Though if you’re a serious investor, you may want to upgrade to Quicken Premier.) What’s new with the 2017 version? Not a whole lot has changed, but there are a couple of upgrades you should know about, including:. Mobile: Now you can download the Quicken app to track your investments and budget on the go.

The mobile app has a nice interface with everything you’ll find in the desktop version. Plus, you can add budget line items as you spend. Advanced Search: You can find mobile transactions more easily with the mobile advanced search feature. Refresh: Quicken got a refresh this year. The screen looks nicer, and the interface is a little more user-friendly. It’s not a major overhaul, but it’s easy on the eyes. Zillow: You can connect with to automatically import your home’s estimated value.

While Zillow may not be the most accurate option if you’re actually getting ready to buy or sell a home, this is a simple way to get a ballpark idea of your home’s value when calculating your net worth. Alerts: You can get alerts sent to your phone or email inbox when bills are due or when you’re about to go over your budget. Receipt Storage: Need to track expense receipts, but tired of paper clutter everywhere? You can snap photos of your receipts and store them with the mobile app. Once you get set up, keeping track of everything in Quicken is relatively simple.

Here’s what it all looks like: First, import your accounts As with other popular, Quicken will automatically sync with your bank and credit card accounts, as well as your investment accounts. This makes it easy for you to track transactions without having to enter them manually. In fact, the very first thing Quicken asks you to do after you enter your credentials is to sync a new account. To make it happen, you’ll just need your account’s login information. You can import all sorts of accounts, even to the basic version of Quicken, though investment tracking is more robust with the higher-level versions. Next, check your recent transactions When your accounts are imported, it can seem a little overwhelming at first.

Quicken automatically categorizes your transactions, but you’ll likely have to go through a recategorize many of them. Quicken will give you the last thirty days’ worth of spending information to work with. I do like how the system breaks everything down graphically. Once you set all of your transactions into categories, you can see what percentage of your budget goes to each category, and check out a corresponding chart breaking down your spending. It looks like this: You can see that Quicken will alert you when there are uncategorized transactions. You can click into that directly to see those transactions.

Then, you can sort your transactions by account, date, and type of spending (with or without taxes). You can also click into spending categories to figure out which transactions Quicken has placed into which categories. Chances are you’ll want to change some of those if you’re a budgeting stickler! Try the bill reminder system Once you’ve been in the spending category interface, you can use the bill system to remind you when your bills are due.

It’ll look at your last two months’ worth of transactions and find recurring bills and their due dates. The system will also track any paychecks you have automatically deposited to your bank account.

You can then set up the reminders, which will alert you when bills are due and project your checking account balances over the next 12 days, based on your upcoming income and expenses. Since it’s not accounting for one-off spendings like groceries and gas, this balance isn’t very accurate.

At least not for me! But it can be a helpful way to stay on top of your bills so you don’t miss any due dates. You can also sign up to have Quicken actually pay your bills for you. This requires a validation of your bank account and a monthly payment of $9.95. Since many banks offer free bill pay services, this one may not be worth the additional spend. Create a budget As with other pieces of this interface, Quicken will automatically create a budget for you based on past spending.

However, this spending is according to Quicken’s categorizations. If you think Quicken has gotten a few things wrong, it’s best to re-categorize your existing transactions before delving into the budget tab. Once you do, though, you can get access to a quick budget that you can change from there.

The budget interface now looks very similar to Intuit’s Mint.com, which features slider bars to show how close you are to the budget limit in each category. You can, of course, change the budget for each category depending on your preferences and needs. You can also look at the budget in terms of only certain bank accounts, toggling between transactions in each account on the left sidebar. One of the interesting things about this budget interface is that you can run various reports. These come out as very nice, color-coded documents that you could print off or store electronically, for an over-time view of your personal finances. You can run reports for a variety of scenarios, including spending by category, spending versus available budget, income versus expenses, or spending for the month versus average spending by category.

These over-time reports will become more useful the longer you use Quicken, which gives it more data to pull from. But some of the reports look like this: These reports could be really helpful if you’re trying to meet specific, like reducing spending in a few categories or tracking your budget over time. What about upgrades? My review has been based on, but there are other options currently available, too. Here’s a quick breakdown of what they offer: Quicken Deluxe. Tracks all types of financial accounts. Offers the ability to create a plan for.

Let’s you run checks to see if you’re on track for retirement. Read more reviews and Quicken Premier. Offers a deeper look into. Helps you find mutual funds for investing. Minimizes taxes on taxable investment accounts. Read more reviews and Quicken Home & Business.

Ad Hoc Dates For Net Worth Report In Quicken For Mac

Categories both business and personal transactions automatically. Tracks profit/loss projections and generates cash flow reports. Minimizes business tax burden. Read more reviews and Quicken Rental Property Manager. Categories transactions related to. Organizes tenant information.

Ad Hoc Dates For Net Worth Report In Quicken For Mac

Tracks income, expenses, profit, and loss by property. Read more reviews and Is Quicken right for you? Quicken offers a load of great features, and its new interface is definitely more user-friendly than the last version I reviewed in 2014. If you want a one-stop-shop for tracking all of your personal finance details — from budgeting to investments to debt — then Quicken may be a worthwhile investment. With that said, I don’t think I’d pay for the when free tools like Mint.com can do basically the same thing., though it does come with a $5/month fee. However, if you want to add investment tracking and detailed financial planning into the mix, Quicken Deluxe might be a good option for you. And, of course, if you run rental properties or a small business, you can’t go wrong with the robust business-oriented versions of Quicken.

So, tell us: do you think Quicken is the right option for your personal finance tracking needs?